Asset class recap for May

May was a good month for all asset classes in our table below. Interest rates dropped slightly and corporate earnings reports were generally positive, providing a tailwind for markets. Most asset classes recouped their losses from April, but not much more. Equity asset classes have pressed further into positive territory YTD, while longer dated bonds are still underwater.

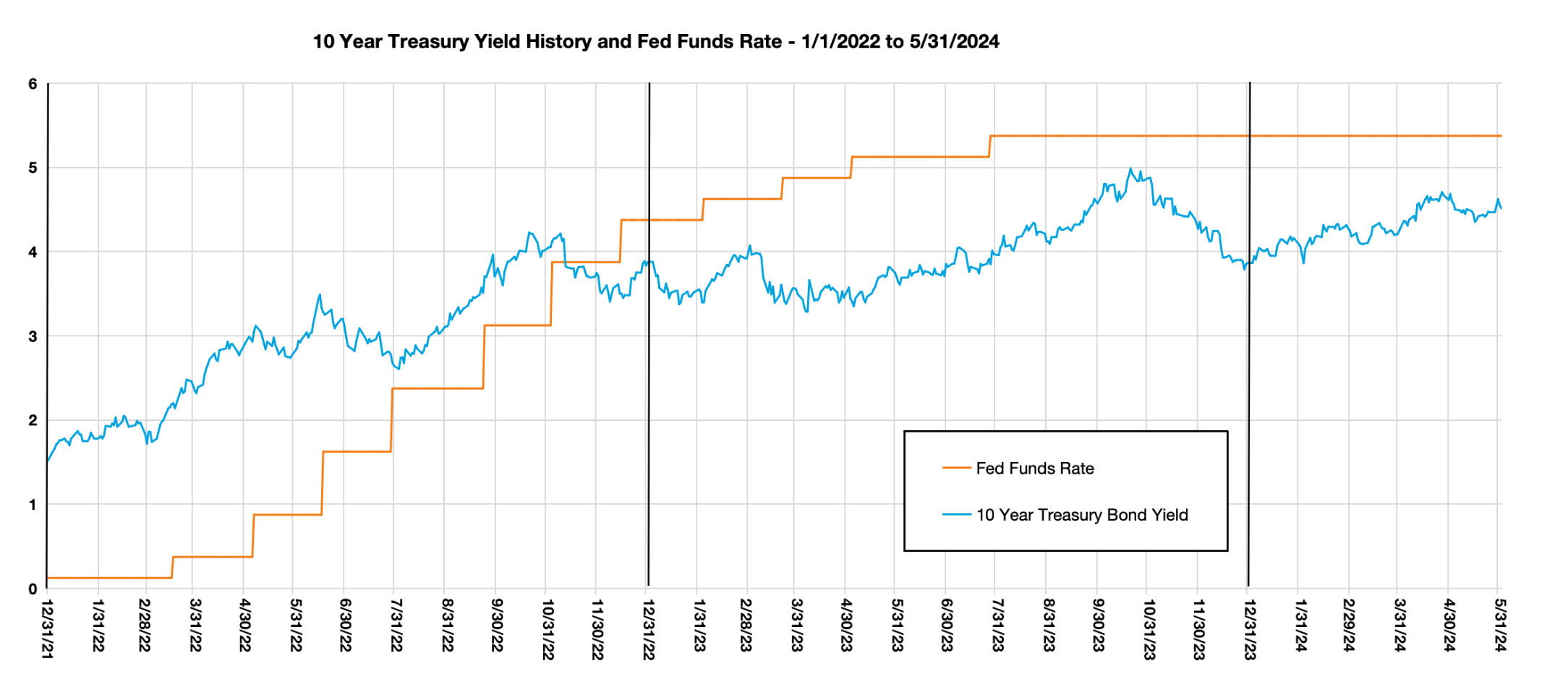

In the financial press, major headlines have continued to be dominated by interest rate concerns and artificial intelligence enthusiasm. The U.S. Federal Reserve has not made any real changes to its positioning or communications with markets, leaving many investors disappointed that their expectations for rate cuts in 2024 are not transpiring. The yield on the 10 year treasury bond dropped slightly during May from 4.69% at 4/30/24 to 4.51% at 5/31/24 and is staying stubbornly below the Fed’s Overnight Funds Rate.

Gold and Bitcoin have both made headlines recently and are enjoying good returns in 2024. Gold started the year at $2,062 per ounce and was up to $2,323 at May 31, for a 12.7% jump. Bitcoin started the year at $42,265 per coin and was at $67,491 at May 31 for an increase of 59.7%. The popularity in these alternative investments may be partly due to the upcoming presidential election, ballooning U.S. federal debt, and a richly valued stock market.

Diversification vs Stock Picking

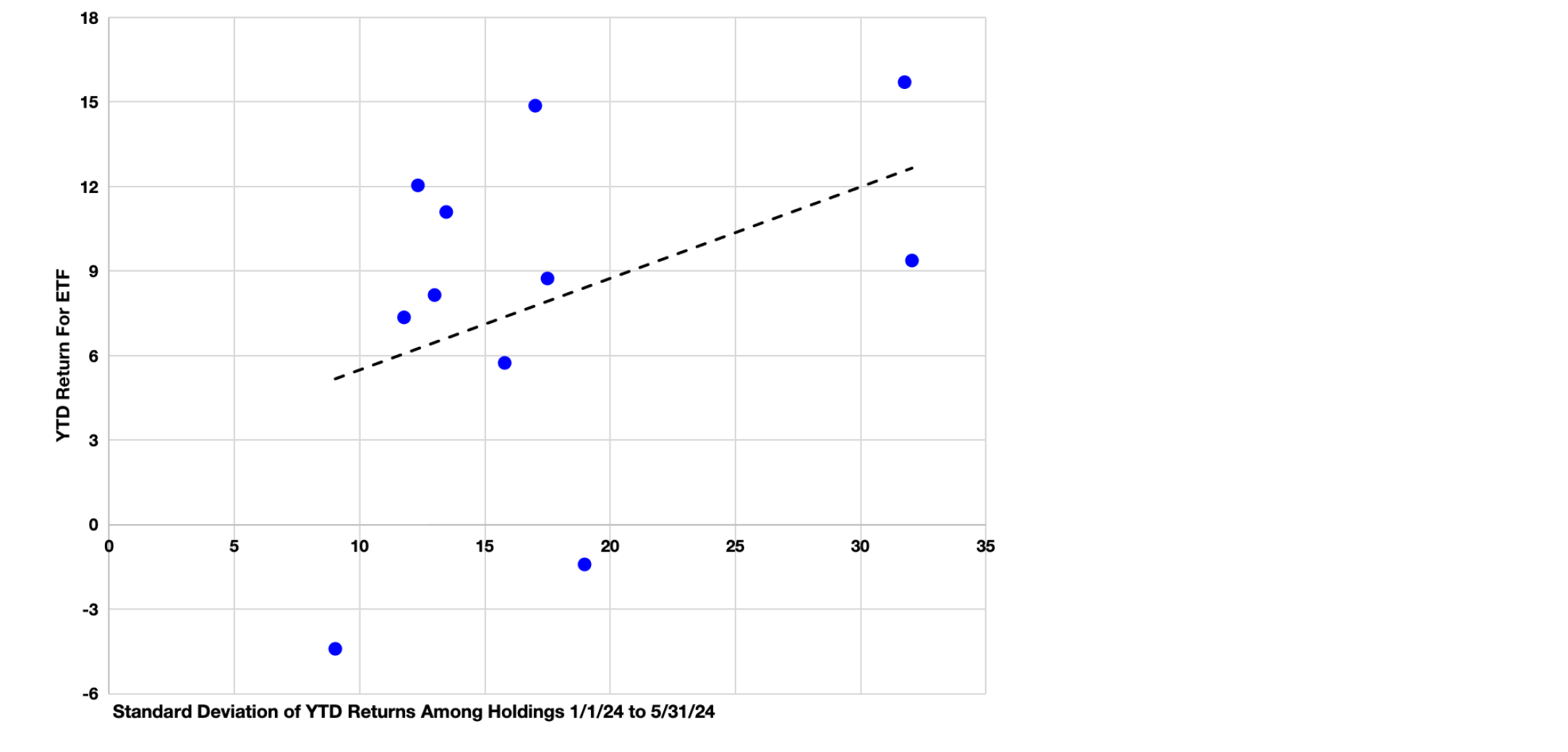

Among U.S. equity sectors, Utilities, Communication Services, Energy, and Financials have each had returns over 10% so far in 2024. Consumer Discretionary and Real Estate have posted negative returns. The table and chart below include risk and return information for State Street’s eleven SPDR sector ETFs as well as the 500 stock holdings that make up these ETFs. In addition to the returns for the high-level ETFs, the table and chart report the variance among the underlying stocks that make up these sector ETFs.

Risk and return charts typically plot the return for a security versus the standard deviation of the time series returns for that security, but we have instead put the standard deviation of YTD returns among the underlying holdings of each ETF on the x-axis. The typical risk/return best-fit line holds – the greater the risk, the greater the reward.

Advisors and investors often ask about the value of owning an ETF in environments like today when it seems that only a handful of stocks are driving the majority of market returns. We like to remind investors (and ourselves) that the risk reduction benefits from diversified funds like ETFs can have a major benefit to portfolios by helping to avoid drawdowns. For every investor who picks a stock in a sector that outperforms the sector’s average, there is a second investor who has picked an underperforming stock. The risk of getting it wrong is immense. Even the best returning sector ETF (Utilities in this year-to-date review) had 10% of its underlying securities post negative returns. Idiosyncratic risk (factors unique to specific corporations) can be diversified away, while systematic / market risk cannot.

Important Disclosures

Opinions expressed are as of the current date; such opinions are subject to change without notice. Advyzon Investment Management shall not be responsible for any trading decisions, damages, or other losses resulting from, or related to, the information, data, analyses or opinions or their use. This commentary is for informational purposes only. The information, data, analyses, and opinions presented herein do not constitute investment advice, are provided solely for informational purposes and therefore are not an offer to buy or sell a security. Please note that references to specific securities or other investment options within this piece should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment or a recommendation for a particular product.

Performance data shown represents past performance. Past performance does not guarantee future results. All investments involve risk, including the loss of principal. There can be no assurance that any financial strategy will be successful. This commentary contains certain forward-looking statements. We may use words such as “expects”, “anticipates”, “believes”, “estimates”, “forecasts”, and similar expressions to identify forward-looking statements. Such forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results to differ materially and/or substantially from any future results, performance or achievements expressed or implied by those projected in the forward-looking statements for any reason.

Investment management and financial advice offered by Advyzon Investment Management is intended for citizens or legal residents of the United States or its territories. Investing in securities involves risks, including but are not limited to; currency risk, political risk, geographic risk, concentration risk, custody risk, asset class risk, management risk, market risk, operational risk, passive investment risk, securities lending risk, tracking error risk, tax risk, valuation risk, and infectious illness risk. Investing in emerging markets may increase these risks. Emerging markets are countries with relatively young stock and bond markets. Typically, emerging-markets investments have the potential for losses and gains larger than those of developed-market investments. A debt security refers to money borrowed that must be repaid that has a fixed amount, a maturity date(s), and usually a specific rate of interest. Some debt securities are discounted in the original purchase price. Examples of debt securities are treasury bills, bonds and commercial paper. The borrower pays interest for the use of the money and pays the principal amount on a specified date. High yield debt (non-investment grade or junk bonds) can be more risky than higher rated debt, typically has a higher default rate than investment grade and treasury debt, and high yield funds can lose principal.

“SBBI” stands for “Stocks, Bonds. Bills, and Inflation”. “Stocks, Bonds, Bills, and Inflation”, “SBBI”, and “Ibbotson” (when used in conjunction with a series or publication name) are registered trademarks of Morningstar, Inc. ©2021 Morningstar.“CRSP” stands for Center for Research in Security Prices. Part of the University of Chicago’s Booth School of Business, the CRSP is a nonprofit organization that is used by academic, commercial, and government agencies to access information such as price, dividends, and rates of returns on stocks.

The indexes noted are unmanaged and cannot be directly invested in. Individual index performance is provided as a reference only. Since indexes and/or composition levels may change over time, actual return and risk characteristics may be higher or lower than those presented. Although index performance data is gathered from reliable sources, Advyzon Investment Management cannot guarantee its accuracy, completeness or reliability.